Cutoff date

The cutoff date is the last day within the payroll cycle.

A cut-off date refers to the specific deadline by which employees' work hours, allowances, deductions, and other relevant information need to be submitted or finalized to be reflected in their upcoming paycheck.

Benefits of a Cut-Off Date

The payroll cut-off date serves three critical purposes that ensure a smooth and compliant payroll process:

Ensures Accurate Paychecks: The cut-off date establishes a clear deadline for employees to submit their timesheets, expense reports, and any other information that affects their pay. This guarantees all relevant data, like hours worked, bonuses earned, and deductions, is captured for the specific pay period.

Facilitates Timely Processing: Payroll processing involves various calculations, deductions, and tax withholdings. The cut-off date creates a structured timeframe for employees to submit their required information. This allows payroll departments to efficiently complete all the necessary steps for processing salaries without last-minute scrambling or delays. With a clear deadline, payroll teams can organize their workload, ensure a smooth flow of data, and distribute salaries on time, meeting employee expectations and avoiding frustration.

Maintains Compliance with Regulations: Labor laws and regulations often mandate timely payment of wages to employees. Missing payroll deadlines can result in penalties or legal repercussions for businesses. The cut-off date plays a vital role in ensuring compliance with these regulations. This helps businesses avoid potential legal issues and maintain a positive relationship with their workforce.

How to Determine a Cut-Off Date

Start with your pay frequency. For example, if you pay employees bi-weekly on Fridays, you'll need to calculate backward to determine the cut-off date.

Allocate processing time. Estimate the number of business days your payroll department needs to complete all processing tasks.

Factor in banking lead time. Research the processing time for your direct deposit provider (if applicable).

Combine these factors. Taking the above into account, establish a cut-off date that allows enough time for employees to submit information, for your team to process payroll accurately, and for funds to be deposited by payday.

Tips to Avoid Cut-Off Date Errors

Payroll cut-off date errors can lead to a cascade of issues, from frustrated employees receiving incorrect paychecks to potential legal consequences for missed payments. Here are some key strategies to avoid these errors:

1. Clearly Communicate the Cut-Off Date

Transparency is key. Inform all employees well in advance about the payroll cut-off date for each pay period. Include this information in employee handbooks, payslips, and company intranet sites. Regularly remind employees of the deadline through internal communication channels.

2. Use Automated Timesheet Systems

Manual timesheet tracking is prone to errors. Implementing automated timesheet systems allows employees to electronically record their hours, reducing the risk of missed entries or inaccurate data. These systems can also streamline the approval process and ensure timely submission before the cut-off date.

3. Establish a Pre-Payroll Review Process

Before finalizing payroll, conduct a thorough review of all submitted data. This includes scrutinizing timesheets for inconsistencies, verifying leave requests, and ensuring all deductions and allowances are applied correctly.

4. Reconcile Bank Statements Regularly

Regularly reconcile your bank statements with payroll records. This helps identify any discrepancies related to direct deposits or check payments and allows for prompt correction before impacting employees.

5. Leverage Payroll Software

Investing in robust payroll software can significantly reduce errors. These systems automate many payroll tasks, including calculating deductions, generating paychecks, and ensuring timely tax filings. Look for software with features like built-in reminders for cut-off dates and automated notifications for missing data.

6. Train Payroll Staff

Ensure your payroll team is well-versed in all aspects of payroll processing, including cut-off dates and their significance. Provide them with ongoing training on relevant regulations and best practices to maintain accuracy and efficiency.

7. Implement a Two-Person Review System

Minimize the risk of single-point errors by establishing a two-person review system for payroll processing. This involves having a dedicated staff member verify the work of another before finalizing payments.

8. Prepare for Unexpected Events

While you can't predict everything, have a contingency plan in place for unexpected situations like employee illnesses or system outages near the cut-off date. Consider setting an earlier deadline for submission of critical information in such scenarios.

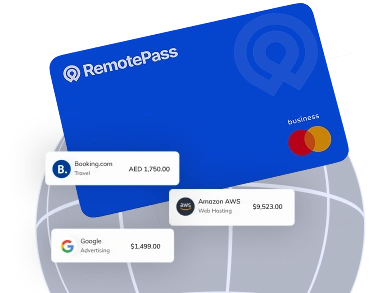

Process Payroll with RemotePass

RemotePass offers a comprehensive payroll system granting you access to unparalleled financial services and benefits, such as USD Debit card, premium health insurance options, and 7 payout methods supporting 175+ currencies.

Related Glossaries

Relocation

Relocation refers to the process of moving an employee from one geographical location to another, typically to support business needs.

EOR

EOR stands for Employer of Record.

Health insurance

Allows individuals to receive medical, dental, vision, and other medically-related care.

Related Articles

Remote Work Productivity: How to Get the Most From the Future of Work

This article explores remote work productivity and the links between this method of working and enhanced output from global teams, to help you to achieve more.

.svg)

_EasiestToDoBusinessWith_EaseOfDoingBusinessWith%20(1).svg)

.svg)