Gross salary

The gross salary corresponds to the total payments received by the employee.

Gross salary is the total amount of money an employee earns from their employer before any deductions, taxes, or other contributions are taken out. It represents the full earnings on paper, including not just the base salary but also any additional earnings such as commissions, bonuses, and overtime pay. This figure is important as it reflects the employee’s earnings potential and forms the basis for determining net pay, benefits, and tax obligations.

Components of Gross Salary

The gross salary includes multiple components that can vary depending on the employee’s role, performance, and employment agreement. Here’s a breakdown of the primary elements:

- Base Salary: The base salary is the fixed, regular payment that an employee receives per pay period, such as monthly or bi-weekly. It’s typically determined by the job role, market rates, and experience level. This is the foundation of the gross salary and often the most stable component.

- Commissions: For roles involving sales or performance targets, commissions provide additional earnings based on the employee’s output, such as sales closed or milestones achieved. Commissions are usually calculated as a percentage of the sales value or based on specific performance metrics, making them a variable part of gross salary.

- Bonuses: Bonuses are extra payments awarded to employees for various reasons, including performance, achieving company-wide goals, or hitting individual or team targets. These can be annual, quarterly, or project-based and are typically paid at the company’s discretion.

- Overtime Pay: Overtime compensation is provided to employees who work beyond their scheduled hours. In many regions, employers are legally required to pay employees a higher rate for overtime, often calculated as 1.5 or 2 times their hourly rate. Overtime pay can significantly increase an employee’s gross salary, especially in roles that require long hours.

Gross Salary vs. Net Pay

Gross salary and net pay are often confused, but they represent two distinct figures on an employee’s paycheck.

- Gross Salary is the total earnings before any deductions, taxes, or contributions are subtracted. It’s a pre-tax figure that encompasses the base salary, commissions, bonuses, and overtime.

- Net Pay (or "take-home pay") is what remains after deductions from gross salary. These deductions typically include:some text

- Taxes: Federal, state, and local income taxes based on the employee’s earnings and tax bracket.

- Social Security and Medicare: Mandatory deductions in many countries to support national social programs.

- Health Insurance: Contributions to employee health insurance plans, often shared between employers and employees.

- Retirement Contributions: Deductions for retirement accounts, such as 401(k) plans in the United States, pension schemes, or other retirement savings plans.

The difference between gross salary and net pay can be significant due to these deductions, making it essential for employees to understand what is taken out of their gross salary and why.

Gross Salary and Remote Work

As remote work continues to reshape the workforce, employees and employers may wonder if remote work affects gross salary. Generally, an employee’s remote work status does not change the calculation of gross salary. Whether an employee works from the office or remotely, their gross salary remains the same as per their employment contract, which outlines the base salary and any additional earnings components.

However, gross salary can be indirectly impacted by remote work if the company’s policies adjust for location-based salaries. For instance, if a remote employee moves to a region with a lower cost of living, some employers may adjust the gross salary to reflect local market rates. It’s important for both employers and employees to clarify if remote work has any impact on salary calculations in such cases.

Importance of Understanding Gross Salary

For both employees and employers, a clear understanding of gross salary is crucial for financial planning, tax purposes, and career development.

- Budgeting and Financial Planning: Knowing one’s gross salary helps employees with budgeting, as it provides a baseline for calculating monthly income and expenses. Employers also rely on gross salary calculations for payroll budgeting, which is essential for overall business financial planning.

- Tax Calculations: Gross salary is the starting point for tax deductions and calculations. Knowing this figure helps employees anticipate their tax obligations and plan for deductions. Employers also use gross salary to ensure compliance with tax regulations and proper withholding for payroll taxes.

- Salary Negotiations: In salary discussions, gross salary serves as the primary figure for negotiations. Employees should be aware of their gross salary to understand the full value of their compensation package, including bonuses, commissions, and other earnings components. This allows them to negotiate more effectively based on market standards and personal financial goals.

- Benefits Calculations: Gross salary often determines eligibility and contribution levels for various benefits, such as retirement savings plans and health insurance. Employers may calculate certain benefits as a percentage of an employee’s gross salary, meaning a higher gross salary can lead to increased benefits contributions.

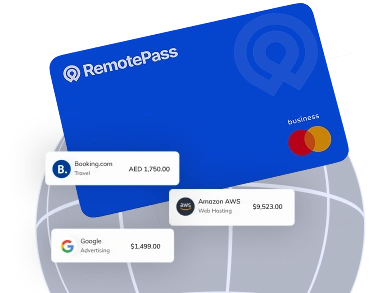

Simplify Global Payroll with RemotePass

Calculating gross salary across multiple countries can be complex, but RemotePass makes it easy. Our platform helps you manage payroll seamlessly for your global workforce, ensuring accurate gross salary calculations, compliance with local regulations, and automated deductions—all in one place. With RemotePass, you can streamline your payroll processes and keep your team paid on time, no matter where they are.

Related Glossaries

Form 1099

A 1099 is another IRS form, most commonly used by employers when they hire contractors.

Work permit

A work permit is an official document giving a foreigner permission to take a job in a country.

Part-time employee

A part-time job is a form of employment that carries fewer hours per week.

Related Articles

The Ultimate Guide to Using Organizational Charts for Successful Remote Team Management

This guide explains the different types of org charts, explore their specific benefits for remote teams, and show you how RemotePass can automate their creation.

.svg)

_EasiestToDoBusinessWith_EaseOfDoingBusinessWith%20(1).svg)

.svg)