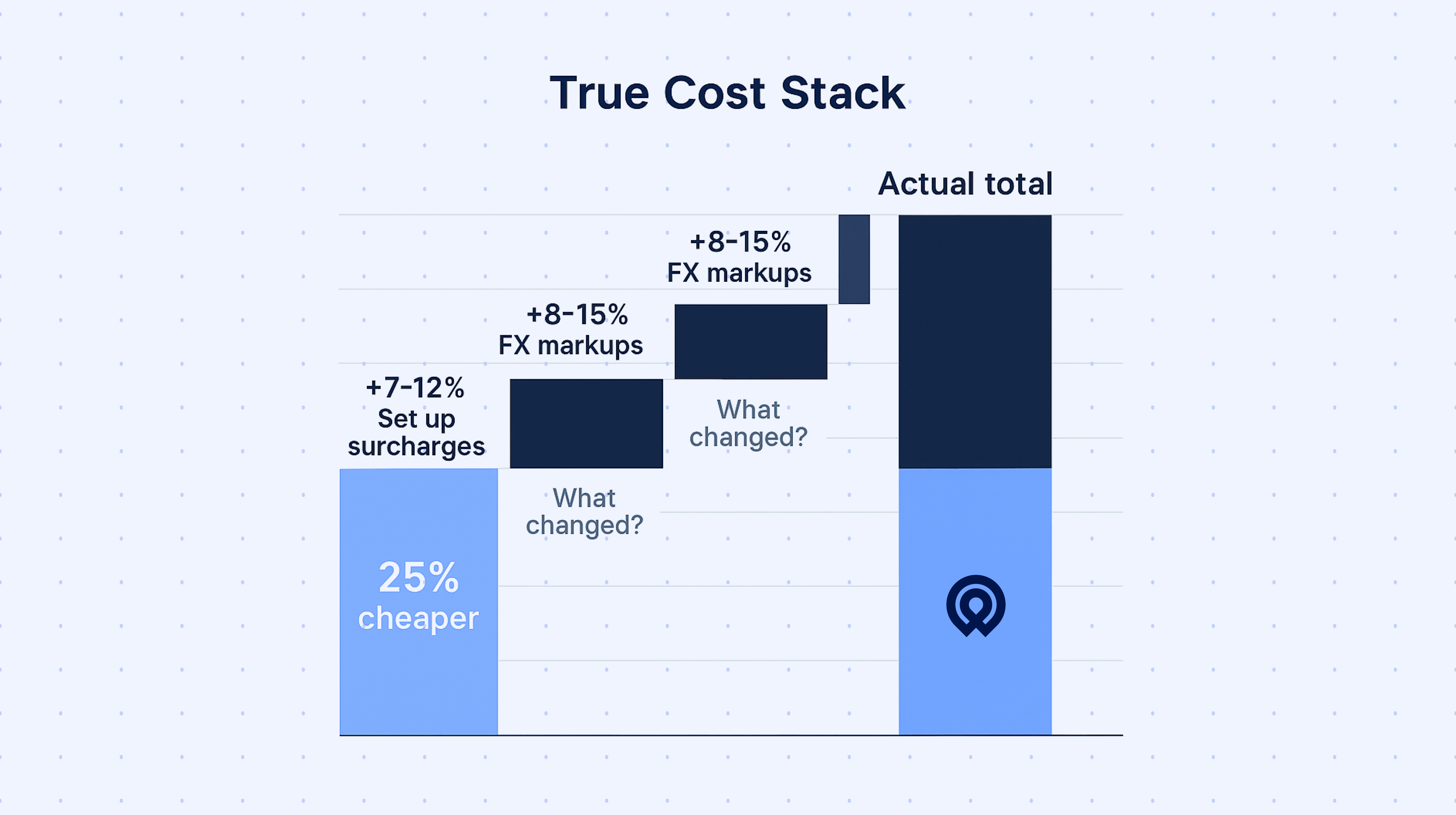

Expansion promises new markets and talent but it often comes with a nasty surprise: hidden costs of global hiring. That “25% cheaper” rate you saw? It can swell by another 20–40% once you factor in setup surcharges, currency markups, and surprise admin charges. Finance teams end up scrambling to plug budget gaps, and decision-makers stall plans while hunting for clarity.

This guide pulls back the curtain on every cost component—entity setup, cross-border payroll, per-person retainers, and optional services—so you can compare self-managed hiring, standard EOR offerings, and RemotePass’s transparent model side by side.

We’ll map out true total costs, share hands-on tips to shave expenses, and show why our flat, predictable fees often save you more in the long run.

Ready for a straight-talk, line-by-line breakdown? Let’s dive in.

Setup Fees

A setup fee is a one-time charge that gets your global hiring process off the ground. It covers everything from legal entity registration and mandatory filings to the initial configuration of the payroll and HR system. Without this fee, you’d face delays and gaps in compliance that can lead to fines or stalled hires.

Typical Components

- Entity Registration & Compliance Checks

Providers handle local business registration or partner with a trusted entity, file necessary paperwork, and confirm adherence to regional labor laws. This step ensures your company can legally onboard people in each country. - Onboarding Resources (Contracts, Templates)

You receive tailored employment contracts, contractor agreements, and standardized templates for NDAs or data-protection addenda. Many providers also set up digital signature tools and KYC/AML workflows so you can hire at scale without reinventing the wheel.

Industry Benchmarks

Across leading EOR and contractor-management services, setup fees usually range from $200 to $1,500 per country. Less regulated markets—like some in Latin America or Southeast Asia—sit near the bottom of that range. High-compliance jurisdictions (think KSA, UAE, Germany) often incur fees closer to the top. If you expand into five or more countries at once, many providers offer volume discounts that lower your average per-country cost.

RemotePass Approach

RemotePass charges a single, flat setup fee that bundles all entity and onboarding tasks. We don’t split out “legal admin” or “document surcharges” later—what you see in your quote is what you pay. That transparency lets you plan budgets accurately and avoid last-minute surprises.

Pro Tip

If you’re entering multiple markets, group those countries under one agreement. Bundling cuts your per-country fee and unlocks tiered discounts. For example, adding Spain and Italy together often costs less per country than signing separate contracts, helping you get live faster and at a lower price.

International Payroll & Transfer Fees

When you pay people across borders, you face two main fee types: fixed per-transfer charges and percentage-based fees on the total payroll amount. Knowing how each works helps you pick the model that cuts your costs.

Fixed-Fee Transfers

With fixed-fee transfers, you’ll pay the same dollar amount every time, regardless of the payroll size. That predictability makes budgeting simple—just multiply the fee by your pay runs. But if you routinely send large payouts, flat fees can eat into your savings. High-volume teams may find themselves paying more in fees than with a percentage model.

Percentage-Based Fees

Percentage fees scale with your payroll. Charging, say, 1% of each transfer keeps costs proportional: a $10,000 payroll costs $100 in fees, a $50,000 payroll costs $500. It’s fairer for big pay runs. Yet smaller teams might see higher relative costs, especially if the percentage sits near the 3% end. Look out for minimum flat-fee floors that kick in when percentages dip too low.

RemotePass’s Transfer Model

RemotePass charges a clear 1% transfer fee across all currencies. As your monthly transaction volume grows, you unlock tiered discounts that can shave fractions off that rate. You won’t find surprise per-transfer minimums or hidden banking markup—just a single line item on your invoice. That transparency helps you forecast costs and compare quotes side by side.

You can find more details on our RemotePass pricing tiers.

Pro Tip: Sync Your Pay Dates

Rather than paying each team or region on different days, align everyone to a single monthly pay date. Fewer transfer events mean fewer flat fees or percentage calculations.

Monthly Retainers & Per-Person Fees

When you bring someone on payroll—whether a contractor or a full-time hire—you pay a monthly fee that covers vital back-office work. Here’s what that fee typically includes:

- Payroll runs: Automated salary distributions in local currency, on schedule.

- Tax filings: Preparation and submission of payroll taxes to the right authorities.

- Benefits administration: Management of health plans, retirement contributions, and other perks.

- Compliance monitoring: Ongoing checks against labor laws, reporting deadlines, and regulatory updates.

What the Market Charges

Most global-hiring platforms price per person and bill monthly. For full-time employees, you’ll see rates from $199 to $800 per employee. Contractor-focused plans run much lower—$39 to $349 per contractor each month, depending on services and region. If you compare a lean contractor plan to a full EOR package, you’re often trading off simplicity for cost.

RemotePass’s Tiered Structure

We built three clear tiers so you pay only for what you need:

- Contractors – $39/mo

Ideal for short-term projects or freelance talent. You get payroll runs, basic compliance checks, and access to our platform. - Contractor of Record – $299/mo

Everything in the contractor plan, plus formal hiring support, contract templates, and local entity services in 150+ countries. - Employer of Record (EOR) – $349/mo

Full HR and payroll suite: benefits admin, tax filings, unlimited compliance monitoring, and premium support. Perfect for long-term headcount and peace of mind.

Why Tiered Pricing Wins

A flat per-person rate simplifies budgeting. You won’t juggle add-on fees or surprise surcharges. And if your mix of contractors and employees shifts, you can easily move between plans without renegotiating your entire agreement.

Pro Tip: Match the plan to your team makeup. Use the $39 contractor tier for gigs and pilots. Switch to EOR for headcount you plan to scale. This approach keeps your costs lean and your processes consistent.

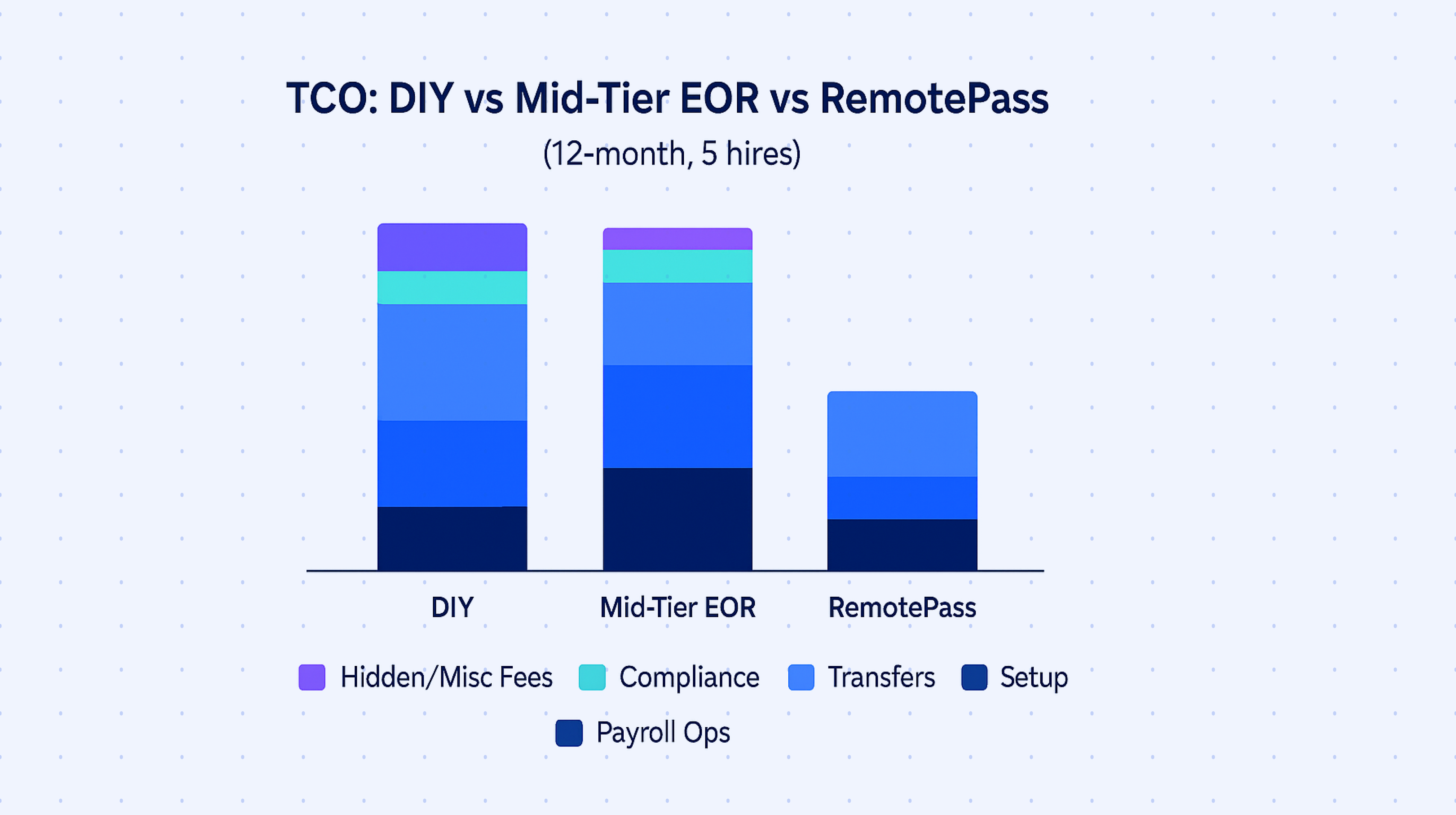

Total Cost of Ownership (TCO) Comparison

Imagine you hire five people and run payroll for a year under three models: DIY local entity, a mid-tier EOR, and RemotePass EOR.

Here’s how the numbers stack up:

DIY Local Entity

You register in each country, handle payroll, file taxes, buy insurance, and manage benefits. Upfront setup alone can exceed $5,000 across five jurisdictions. Monthly admin costs—software, accountant fees, legal counsel—add another $1,000 per country. Over 12 months, you spend roughly $70,000 before including headcount costs. Errors or missed deadlines can trigger fines, further inflating your bill.

Mid-Tier EOR (Competitor)

Most providers quote low base rates—say $250 per person per month—but tack on hidden charges. You pay setup fees, cross-border transfer surcharges, “service levies,” and compliance pass-throughs. These misc fees often total 15% of your annual spend, buried under vague line items. For five hires, that can mean an extra $31,500 over the year. In all, you’re looking at about $85,000 and you’ll only discover the true cost after you sign.

RemotePass EOR

We bundle setup, transfers, payroll, benefits, taxes, and compliance into clear, per-person rates: $349/month for EOR. No surprise add-ons. For five employees over twelve months, your total cost is $20,940. You get unlimited support, legal filings, and global transfers—all included.

ROI Thresholds

- DIY makes sense if you have ten or more hires per country and in-house legal and finance teams.

- Mid-Tier EOR works for smaller headcounts if you can handle bill shock.

- RemotePass EOR beats both when you value predictability, streamlined operations, and true end-to-end service, especially if you plan rapid growth in multiple markets.

Why Using RemotePass Saves You More

- Flat, Transparent Pricing – No hidden setup or admin fees.

- Low Per-Person Rates – EOR from $349/month; contractors from $39/month.

- 1% FX Transfer Fee – No surprise currency markups or transfer surcharges.

- All-Inclusive Services – Payroll, tax filings, benefits, and compliance bundled in.

- Scales With You – Discounts as your headcount grows—no tier-jumping surprises.

- Fewer Vendors, Lower Overhead – One platform for 150+ countries.

Ready to simplify your global hiring process?

Book a demo today and watch RemotePass handle payroll runs, tax filings, benefits administration, and cross-border transfers across 150+ countries.

.svg)

.svg)

_EasiestToDoBusinessWith_EaseOfDoingBusinessWith%20(1).svg)

.svg)