You've found the perfect developer in Portugal. The problem? You don't have a legal entity there, and setting one up will take six months and cost you a small fortune.

RemotePass is a global HR platform with in-house experts who've helped hundreds of companies navigate exactly this situation. This guide covers what an Employer of Record is, when it makes sense to use one, and what to watch out for before you sign a contract.

Employer of Record Definition

An Employer of Record (EOR) is a third-party organization that becomes the legal employer of your workers in countries where you don't have a legal entity.

You find and select the talent. The EOR handles everything else: employment contracts, payroll, tax withholding, benefits administration, and compliance with local labor laws.

Here's what that looks like in practice. Say your US-based software company wants to hire a senior developer in Portugal. You interview candidates and choose who you want. The EOR:

- Creates a Portuguese employment contract that complies with local labor laws

- Registers the employee with social security

- Processes monthly payroll in Euros

- Provides mandatory employee benefits like health insurance

- Files all required tax paperwork with Portuguese authorities

You still manage your employee’s day-to-day work. The EOR manages the employment relationship legally.

The distinction matters because in most countries, whoever signs the employment contract carries the legal risks. With an EOR, that's them, not you. If Portuguese labor law changes or a dispute arises, the EOR is responsible for staying compliant and managing it correctly.

5 Scenarios When You Should Use an Employer of Record (and When You Shouldn’t)

EOR services aren’t the right solution for every hiring scenario. Here’s when an EOR makes sense.

1. You're Testing a New Market

When you're exploring whether a region is viable before committing to a permanent presence, an EOR lets you hire local talent and gather market intelligence without the timeline and cost of setting up an entity.

If the market doesn't pan out, you can wind down without the hassle of closing a legal entity.

2. You're Hiring Remote Workers Internationally

If your team is distributed across multiple countries with just a few people in each location, an EOR scales more efficiently than establishing separate entities everywhere.

You get compliant employment in each jurisdiction without the overhead of managing eight different corporate structures, bank accounts, and local accounting relationships.

3. You're Running a Short-Term Project

Fixed-term contracts of 12-18 months in different countries don't justify the time and expense of entity setup. By the time you set up and shut down a local entity, the project would be over

An EOR handles the arrangement cleanly from start to finish, including proper termination according to local requirements when the project ends.

4. You Don't Have the Resources to Manage Multi-Country Compliance

Labor laws change frequently, sometimes multiple times a year. Unless you have dedicated international HR expertise tracking regulatory changes across jurisdictions, staying compliant is a full-time job.

An EOR monitors these changes and updates contracts and processes automatically.

5. You're Hiring Leadership or Strategic Roles in New Markets

When you need a country manager or senior executive on the ground before you have the headcount to justify entity setup, an EOR ensures they're employed properly from day one. This bridges the gap until you're ready for a full local presence.

When an EOR Doesn't Make Sense

If you're planning to hire 20+ people in one country with long-term commitment, establishing your own entity typically becomes more cost-effective.

If you need very tight control over HR processes and employee data, or if you're in a heavily regulated industry with unique compliance requirements, direct employment might be better.

The Key Services an Employer of Record Offers

EORs handle the administrative and legal work that you’d have to take care of yourself with your own entity. Every provider is different, but you can generally expect them to cover:

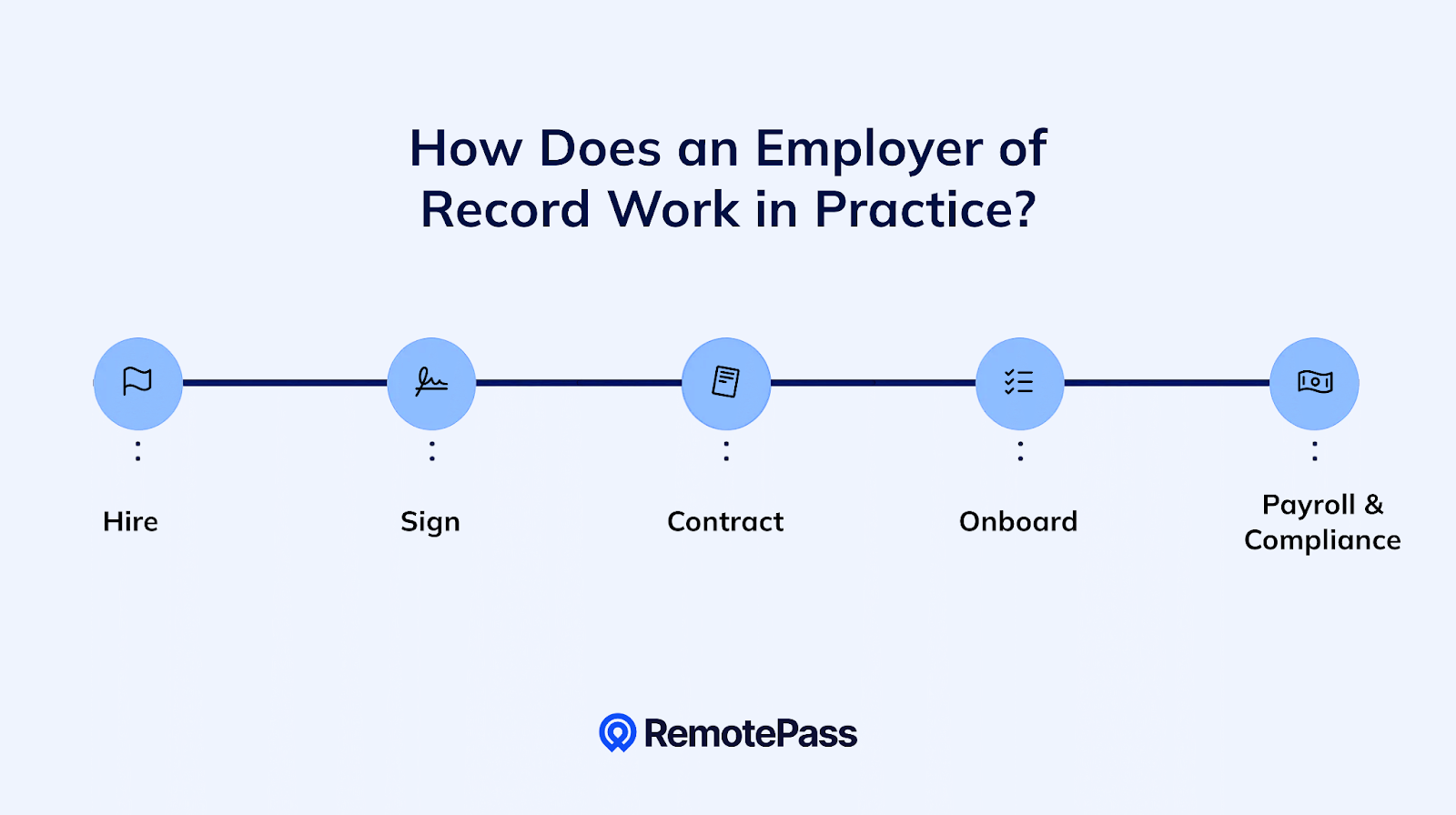

How Does an Employer of Record Work in Practice?

Once you’ve signed up with an EOR, hiring someone in a different country typically looks like this:

- Step 1: You hire new talent. Run your normal hiring process. Post jobs, screen candidates, conduct interviews. The EOR doesn't recruit for you. You make the hiring decision.

- Step 2: Sign an agreement with the EOR. You and the EOR sign a service agreement outlining responsibilities, fees, and terms. This usually takes a few days once you've reviewed and negotiated terms.

- Step 3: The EOR creates the employment contract. They carry out verification and background checks and draft a locally compliant contract based on the role, salary, and benefits you've agreed on.

- Step 4: Onboarding and setup. The EOR registers your employee with local tax authorities, sets up benefits enrollment, and handles all administrative paperwork. Your new hire provides documents like tax identification numbers and bank details directly to the EOR.

- Step 5: Ongoing payroll and compliance. Every pay period, you approve timesheets or salary amounts. The EOR processes payroll, withholds income tax and social contributions, pays the employee in local currency, and files required government reports. When labor laws change, the EOR updates contracts and processes to stay compliant.

If you need to terminate the employment, the EOR manages the process according to local requirements. That includes calculating severance, providing required notice, and handling final payments.

How Employer of Record Pricing Works

Most EOR providers charge a one-off setup fee for each country you hire in, plus a monthly fee per employee.

Some providers use flat-rate pricing that's the same regardless of location. Others adjust fees by country based on local compliance complexity. RemotePass's EOR pricing starts at $349 per employee per month.

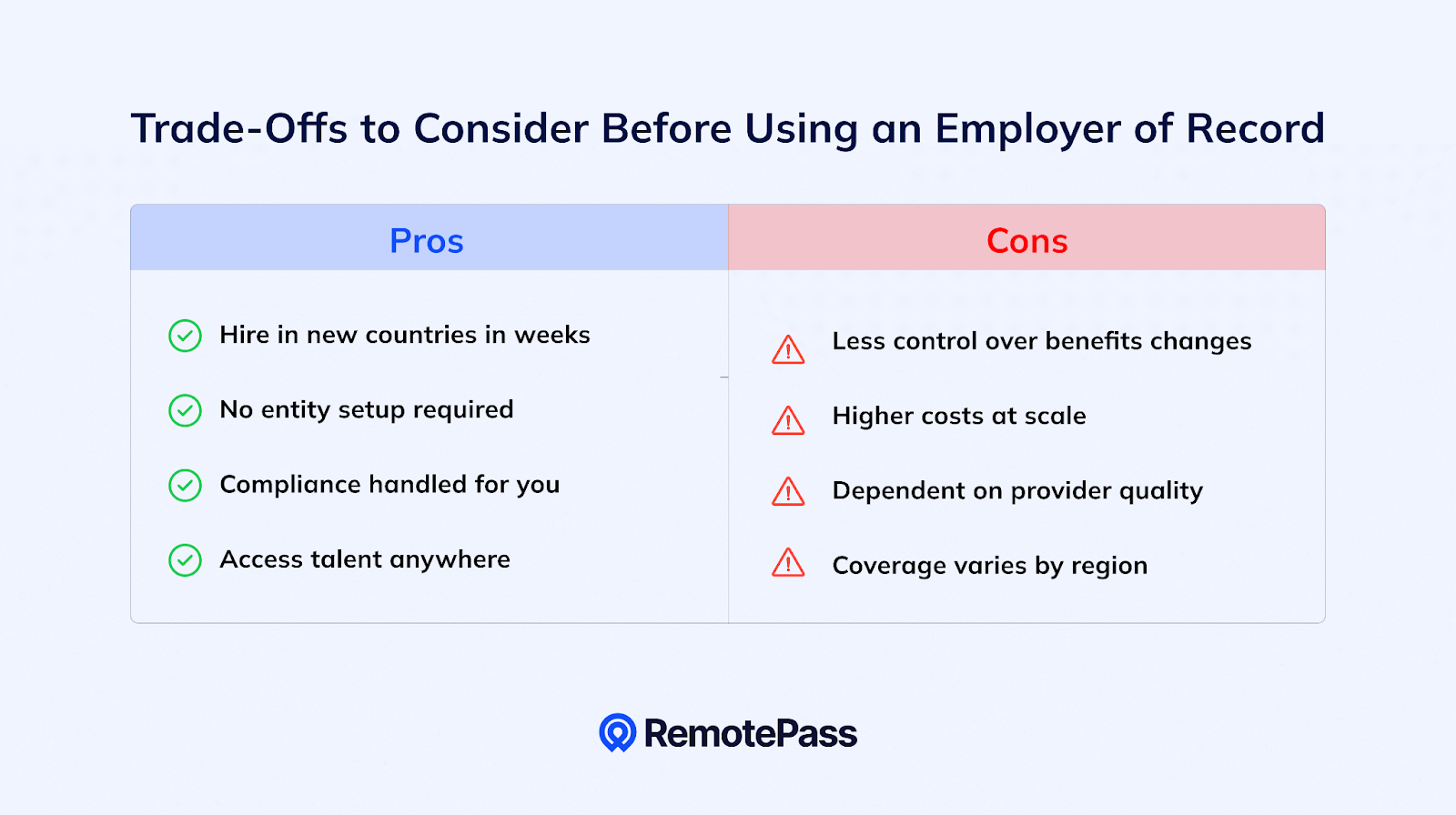

Trade-Offs to Consider Before Using an Employer of Record

EORs solve a big problem, but they can create others. Be realistic about the trade-offs.

Less Direct Control Over HR Processes

You can't just decide to modify the benefits package or change compensation structures on your own. Changes to employment terms go through the EOR, adding time and sometimes requiring renegotiation.

If you have specific benefits philosophies or want to adjust leave policies beyond legal minimums, you're working within their framework and local employment law constraints. What this means in practice:

- If a competitor offers better benefits and you need to respond quickly, you can't just implement changes. You need EOR approval and might face additional costs.

- Maintaining consistent employee experience is harder. Your direct employees might have different benefits or perks than your EOR-employed staff.

- Company-specific benefits that differentiate your employer brand (unique parental leave, sabbatical policies, learning stipends) might not be possible through the EOR's framework

Higher Costs When You Hire at Scale

EOR fees typically run USD 300-600 per employee per month. For three employees, that's manageable. For 30 employees in one country, you're paying USD 9,000-18,000 monthly.

Most companies start with an EOR and transition to their own entity when the math makes sense. Here's how to figure out when that is:

- Calculate your monthly EOR costs (number of employees × monthly fee per employee)

- Compare against entity costs: Setup, ongoing accounting and legal, plus HR headcount

- The break-even point is typically around 15-25 employees in one country, depending on local costs

Provider Dependency

If your EOR has slow support, makes payroll errors, or mishandles compliance, your employees suffer and you have limited recourse. Switching EOR providers mid-contract is possible, but it can be complicated and disruptive.

Protect yourself by:

- Testing support responsiveness before signing: ask questions during the sales process and note how quickly they respond and whether answers are thorough

- Checking contract exit terms upfront: understand notice periods, what happens to employee data, and whether there are penalties for switching

- Asking for client references in your target countries: talk to companies with similar team sizes and industries about their experience with accuracy and support

- Setting clear SLAs in your agreement: specify response times for urgent issues, payroll accuracy guarantees, and what happens if they miss deadlines

Coverage Quality Can Vary by Region

Not every EOR operates in every country with equal quality. Some have strong coverage in Europe but limited options in the Middle East. Some might excel in Canada but have weak partnerships in India or Poland.

Before committing to a provider:

- Ask specifically about your target markets: Don't just check if they operate there. Ask about entity ownership vs. partnerships, team size on the ground, and how long they've been operating in that country.

- Request country-specific case studies: See examples of companies they've successfully supported in your exact markets.

- Test their local expertise: Ask detailed questions about labor law in your target country during the sales process. Generic answers are a red flag.

- Check if they have local language support: If your employees will need help in their native language, confirm the provider offers it.

What are Alternatives to an Employer of Record?

An EOR isn't the only way to hire internationally. Here's how other options compare:

EORs sit in the sweet spot when you need compliant employment without entity setup.

Final Thoughts on What is an Employer of Record

An Employer of Record handles the legal employment side, like contracts, payroll, benefits, compliance, while you manage the actual work. It's faster and often cheaper than entity setup when you're hiring small teams across multiple countries.

The model works best for companies testing new markets or building distributed global teams without multi-country compliance resources. It works less well at scale in single countries or when you need tight control over all your HR tasks.

If you're expanding internationally, RemotePass provides EOR services with local expertise across 150+ countries. Book a 15-minute demo to see if it's a good fit for your hiring plans.

FAQs about Employer of Record (EOR)

What's the Best Employer of Record?

There's no single best EOR. It depends on where you're hiring and what services you need. Evaluate providers based on coverage in your target markets, service quality, and pricing. Talk to at least three before deciding.

How Much Does an EOR Cost?

Most EORs charge USD 300-600 per employee per month. Watch for additional costs like setup fees (USD 100-500), benefits administration, and work permit sponsorship (USD 500-2,000). Some charge a percentage of salary (8-15%) instead of flat fees.

Who Handles Payroll Taxes and Tax Compliance with an EOR?

The EOR handles all payroll taxes and tax compliance for your employees. They withhold income tax, deduct social security contributions, file employer tax returns, and submit all required reports to local tax authorities.

You don't need to register for local tax IDs or manage tax filings yourself. The EOR is the legal employer on record and carries those responsibilities.

Can I Onboard Contractors Through an EOR?

No. EORs handle employees only. You can engage contractors directly with a service agreement. Some providers, like RemotePass, offer contractor management services to help with payments, compliance documentation, and invoicing at scale.

.svg)

.svg)

_EasiestToDoBusinessWith_EaseOfDoingBusinessWith%20(1).svg)

.svg)