The rise of remote work since 2020 has opened doors to a world of talent and flexible work arrangements. But managing payroll for a geographically scattered team can quickly turn into a compliance nightmare. Juggling tax laws across borders, securing sensitive data on the move, and managing hidden fees all complicate global payroll.

A shocking 2022 report revealed companies make an average of 15 payroll errors per pay period, costing them anywhere from $291 to a staggering $5,000 per month.

That's where the right global payroll solution steps in. Effective providers offer robust compliance features, advanced data encryption, and transparent cost structures to streamline operations and eliminate these burdens.

Featuring insights from industry leaders at Toggl, Catalyst Fund, Motivosity, MIRA Safety, and Select Software Reviews, this comprehensive guide will equip you with the essential factors to consider when selecting a global payroll solutio.

How Global Payroll Works

This section breaks down the three main methods for establishing a payroll process in a foreign country, helping you choose the best approach for your business needs.

Employer of Record (EOR) Model

The Employer of Record (EOR) model involves partnering with a third-party provider who takes on the legal responsibilities of employment. This means the EOR provider manages payroll, taxes, benefits, and compliance with local labor laws on behalf of the business.

Advantages of the EOR Model:

- Simplified Compliance: The best EOR services ensure compliance with local tax regulations, labor laws, and employment standards, mitigating the risk of penalties and legal issues. For example, a U.S. company expanding to the UAE can avoid fines by leveraging an EOR familiar with UAE tax laws.

- Quick Market Entry: Businesses can enter new markets without the need to establish a legal entity, which can be a time-consuming and costly process.

- Cost-Effective: By leveraging the EOR model, companies from startups to enterprises can reduce overhead costs associated with setting up and maintaining local subsidiaries

- Focus on Core Activities: Businesses can concentrate on their core operations while the EOR handles administrative tasks related to employment and payroll.

Ideal For:

- Businesses without a local entity in the country where they operate.

- Startups and small businesses looking to expand internationally without significant investment.

- Companies testing new markets before committing to a permanent presence.

In-House Payroll Operations

In-house payroll operations involve managing payroll, benefits, and workforce management internally, using dedicated HR staff and software solutions. This model requires businesses to have the necessary resources, expertise, and infrastructure to handle all aspects of payroll and compliance.

Advantages of In-House Payroll Operations:

- Full Control: Businesses retain complete control over payroll processes, ensuring they can tailor solutions to their specific needs and policies. For instance, a large corporation can customize payroll policies to match its unique culture and strategic goals.

- Customization: In-house operations allow for highly customized payroll and HR solutions that align with company culture and strategic goals.

- Direct Communication: Direct management of payroll and HR functions facilitates clear and immediate communication with employees, enhancing transparency.

- Data Security: Companies can implement stringent data security measures to protect sensitive employee information.

Ideal For:

- Businesses with the resources and expertise to manage payroll and HR responsibilities.

- Large organizations with complex payroll needs requiring tailored solutions.

- Companies that prioritize direct control over HR functions and processes.

Payroll Compliance in UAE, KSA, Europe & Beyond

Below, we break down critical payroll specifics in the Middle East, Europe, and North America, helping you understand the challenges and solutions for each market.

Navigating Payroll in the Middle East: UAE & KSA Specifics

Expanding into the Middle East, especially the UAE and Saudi Arabia (KSA), requires more than just understanding global payroll basics. We explore them below:

Payroll Compliance in the UAE

In the UAE, payroll is governed by the Ministry of Human Resources and Emiratisation (MOHRE), which enforces strict regulations to protect employee rights and ensure timely salary payments. A central pillar is the Wage Protection System (WPS)—an electronic salary transfer scheme mandatory for private-sector employers. WPS guarantees that employees receive their wages on time, every time, through approved banks and financial institutions.

Employers must submit detailed salary records and comply with strict deadlines for payments and reporting. Non-compliance can lead to fines and penalties. Additionally, the UAE distinguishes between expatriate employees and UAE nationals, with specific social security and labor laws applicable to nationals.

RemotePass Support

Our EOR UAE solution takes the headache out of compliance by managing salary transfers, social security contributions, and regulatory reporting on your behalf. Whether you’re a startup or scaling rapidly, RemotePass ensures you meet all MOHRE requirements effortlessly.

Plus, our full UAE Payroll services cover everything from automated wage payments to local tax filings—so you stay compliant while focusing on growing your business.

Payroll Compliance in Saudi Arabia (KSA)

Saudi Arabia’s payroll system is shaped by its Labor Law and the Human Resources Development Fund (HRDF), which enforces Saudization, mandating that companies employ a set percentage of Saudi nationals. Employers must maintain records demonstrating compliance with these quotas and fulfill payroll reporting requirements monthly.

KSA requires salary payments through approved banks, with rigorous documentation and record-keeping to prevent delays or errors. The introduction of electronic invoicing (FATOORAH) adds an extra compliance layer to payroll operations.

RemotePass Support

RemotePass’s EOR KSA service simplifies these complex regulations by handling Saudization compliance, ensuring timely and accurate salary payments, and managing all required reporting. We take on the administrative burden so you can focus on scaling your operations smoothly. For companies with established legal entities, our KSA Payroll services deliver end-to-end payroll management designed for Saudi Arabia’s evolving regulatory environment.

Key Considerations for UAE and KSA Payroll

- Entity Setup vs. EOR: Establishing a local legal entity in these countries is expensive, time-consuming, and complex. RemotePass’s EOR offerings let you bypass these hurdles, legally employing your workforce while we manage payroll and compliance on your behalf. This approach suits startups and companies testing these markets without committing to a full local setup.

- Currency and Payments: Both UAE dirham (AED) and Saudi riyal (SAR) are pegged to the US dollar, reducing exchange rate volatility. However, payroll must comply with local currency regulations. RemotePass’s multi-currency payroll system ensures seamless salary payments in line with local laws.

- Social Security & Benefits: UAE focuses social contributions primarily on nationals, while KSA enforces Saudization alongside social schemes. RemotePass ensures full compliance with all social security and benefit obligations, including end-of-service payments when required.

Europe: Complex Compliance and Worker Protections

Europe enforces some of the world’s most rigorous labor laws and social protections, with country-by-country variations.

Payroll Compliance

European payroll often requires detailed reporting on taxes, social security, benefits, and work contracts. For example, Germany has strict rules on minimum wage, working hours, and social insurance contributions. France mandates generous employee benefits, including paid leave and healthcare contributions. The UK, post-Brexit, maintains unique payroll tax systems (PAYE), plus national insurance contributions.

Challenges

- Payroll tax codes and social schemes vary widely, demanding specialized knowledge for each country.

- Late payments or errors can lead to heavy fines and employee dissatisfaction.

- GDPR imposes stringent data privacy requirements on payroll data handling.

RemotePass Support

RemotePass streamlines multi-country European payroll compliance, offering centralized management while respecting local specifics. We handle tax filings, social contributions, and statutory benefits, reducing risk and administrative overhead.

North America: Federal and State-Level Complexities

The United States and Canada dominate the North American landscape, each with layered payroll regulations.

United States

US payroll involves federal tax withholding (IRS), Social Security, Medicare, and state-specific payroll taxes. Compliance includes timely tax deposits, filing returns, and adhering to state labor laws (which can vary dramatically). Employee classification and benefits administration add complexity.

Canada

Canadian payroll requires deductions for federal and provincial taxes, Employment Insurance (EI), and Canada Pension Plan (CPP). Provincial variations further complicate payroll management.

Challenges

- Managing multi-state or province payrolls requires compliance with diverse local regulations.

- Employee classification mistakes lead to back taxes and penalties.

- Benefits administration (healthcare, retirement plans) is highly regulated.

RemotePass Support

Our platform ensures payroll accuracy across US states and Canadian provinces, automating tax filings and benefit deductions, reducing risk, and keeping you compliant with local and federal laws.

Asia-Pacific (APAC): Diverse Markets and Rapid Growth

APAC countries like Australia, Singapore, Japan, and India have highly varied payroll and labor law environments.

Payroll Compliance

- Australia mandates superannuation contributions, PAYG tax withholding, and Fair Work compliance.

- Singapore requires Central Provident Fund (CPF) contributions, tax filings, and wage reporting.

- Japan imposes strict social insurance schemes and tax deductions.

- India has complex payroll taxes, provident fund contributions, and labor laws varying by state.

Challenges

- Each country has its own reporting cycles, benefit schemes, and tax authorities.

- Currency conversion and local banking regulations complicate payments.

- Data privacy laws like PDPA (Singapore) or India’s IT Act affect payroll data handling.

RemotePass Support

We help businesses navigate APAC’s diversity by localizing payroll operations with accurate tax filings, social contributions, and compliance monitoring tailored to each jurisdiction.

Challenges of Global Payroll Operations

Regardless of the model you choose, global payroll presents its set of challenges. We'll explore these challenges below, including hidden costs, compliance hurdles, and other roadblocks.

High Cost of Non-Compliance

Ensuring compliance with a myriad of international tax regulations and labor standards is a constant struggle for businesses when paying remote teams. Each country imposes unique requirements concerning income tax, social security contributions, employee classifications, and wage protections.

For instance, while the U.S. Internal Revenue Service (IRS) enforces stringent payroll tax regulations, the European Union imposes additional layers of labor protections and benefits entitlements. In the UAE, the Ministry of Human Resources and Emiratisation (MOHRE) mandates a wage protection system (WPS) for private companies across industries.These variations impose substantial administrative burdens on businesses managing international payroll.

Misclassifying employees further complicates the picture. Companies who fail to properly categorize workers as full-time, part-time, contractors, or freelancers risk owing back taxes and social security contributions. These costly mistakes can have a ripple effect, potentially jeopardizing your ability to operate legally in certain regions.

Currency-Related Frustrations

One often-overlooked, yet significant challenge of global payroll is the issue of currency. Adopting a one-currency-fits-all approach, typically the company's home currency, may seem convenient but can significantly impact employee satisfaction and operational efficiency.

As Richard Morgan, the CEO of Catalyst Fund highlights, navigating "varying currencies" is an inherent complexity of worldwide payroll. This complexity arises due to currency conversion fees and fluctuating exchange rates, which can erode employees' earnings and breed discontent. The resulting frustration can deplete morale and loyalty, potentially increasing turnover rates—an expensive outcome for any organization.

But managing different currencies and local benefits isn’t a walk in the pack either. Roman Zrazhevskiy, Founder & CEO, MIRA Safety, illustrates this with his company’s experience expanding into Europe, where they encountered "meticulous record-keeping and different tax treatments'' compared to other countries.

Delayed Payments

Delayed payments pose a significant challenge in international payroll, as evidenced by a study conducted by SD Worx. The research highlights that nearly half (44%) of European workers have experienced payment delays from their employers. These delays often stem from bottlenecks in processing payments across different time zones and currencies.

Permanent Establishment (PE) Risk

Permanent establishment (PE) risk is a critical concern in global payroll, referring to situations where a company's activities in a foreign country establish a tax residency, even without forming a legal entity there. This can arise from having a physical office, warehouse, or other fixed places of business through which business activities are conducted.

In some jurisdictions, PE can also be triggered by the presence of employees performing specific activities, such as sales representatives securing contracts within the country.

If a company is deemed to have a PE in a foreign country, it can have significant tax implications. The company may be subject to corporate income tax on the profits generated in that country, even if those profits are ultimately repatriated to the home country. This can lead to double taxation, where the same income is taxed in the foreign country and the company's home jurisdiction.

Furthermore, PE status can also trigger additional compliance requirements, such as registering for local tax purposes and filing tax returns. This adds another layer of complexity to global payroll operations.

Data Breach Threat

With geographically dispersed teams, sensitive employee data like Social Security numbers and bank details traverse borders across various systems, increasing the vulnerability to cyberattacks.

A single breach can have devastating consequences on employee privacy and the company's finances. An EY research shows that litigation costs stemming from payroll errors average $3,200 USD per incident, and data breaches can be far more extensive than simple errors.

Furthermore, reputational damage can be severe. When workers feel their personal information hasn't been adequately protected, it can cause a decline in morale and loyalty. The potential impact on customer relationships shouldn't be overlooked either. News of a data breach can spread quickly, raising concerns about a company's commitment to security and potentially reducing customer confidence.

For instance, in 2017, Equifax, one of the largest credit reporting agencies globally, suffered a massive data breach that affected sensitive information, including payroll details, of approximately 147 million people worldwide.

The incident not only resulted in significant financial costs for Equifax (up to $1.4 billion USD), including settlements and legal fees, but also severely damaged its reputation. The breach led to widespread public outcry, regulatory scrutiny, and erosion of customer and investor confidence.

Hidden Costs

Beyond the initial setup, a hidden web of costs can lurk within global payroll, turning a seemingly straightforward expense into a budgetary nightmare. Unexpected fees can quickly erode profitability, as Jonathan Feniak, Head of Finance at LLC Attorney, highlights with his concern about "unusual fees in the fine print" for features like data reporting or premium services.

Currency conversion fees, especially when dealing with multiple countries, can also eat into your bottom line. Alari Aho, CEO of Toggl, emphasizes this point, pinpointing the potential for significant costs associated with currency conversion.

Moreso, integration with existing HR and financial systems can incur unexpected expenses, as Logan Mallory, VP of Marketing at Motivosity, mentions. These integration fees, coupled with potential per-employee charges and international transfer costs, can quickly add up.

Phil Strazzulla, the CEO of Select Software Reviews, raises another crucial point: maintaining a global payroll system often requires additional staff or ongoing training to stay up-to-date with regulations and system updates. This translates to increased operational costs that traditional payroll solutions may not fully account for.

Scalability Issues

Imagine this scenario: you've hired top talent across the globe, but your current payroll solution can't handle the increasing number of employees or the complexities of multiple currencies.

This scenario is all too familiar for businesses encountering the limitations of traditional payroll systems. It is why companies like Motivosity prioritize finding a provider that can scale with the growth of their international workforce.

Scalability isn't just about handling more employees; it's about adapting to the nuances of different regions. Alari Aho, CEO of Toggl, pinpointed this by highlighting the need for a provider that offers "flexibility" to cater to the "diverse requirements of different countries."

Solutions for Success: How a Global Payroll Provider Can Help

Now that we've dissected the complexities of global payroll, let's see how a global payroll solution can help you solve these challenges with confidence.

Streamlining Compliance Processes

Manually sifting through updates and ensuring compliance across diverse jurisdictions can consume valuable resources and leave you exposed to potential penalties. A global payroll provider like RemotePass acts as your dedicated compliance partner, streamlining the process and minimizing the burden on your HR team.

One key feature offered by RemotePass is automated regulatory updates. This ensures your payroll system stays current with the latest legal changes, automatically adapting to new requirements. You no longer need to spend countless hours researching updates or risk falling behind. RemotePass takes care of it for you.

Eliminating Hidden Costs

Transparency is key, and a global payroll provider should be upfront about all associated costs. RemotePass stands out by prioritizing clear and transparent pricing, eliminating the worry of unexpected costs.

Our pricing structure is straightforward and outlines all associated fees upfront, enabling you to make informed decisions without hidden surprises. This transparency fosters trust and ensures you get the most value out of your investment in RemotePass.

Meeting Evolving Business Demands

As your remote team expands across borders, choosing a provider that can adapt and grow alongside your ambition is crucial. Alari Aho, CEO of Toggl, notes the need for a provider that offers “an increasing number of employees without sacrificing service quality.”

RemotePass fits Alari’s description as we built our payroll platform with scalability in mind. Whether you're a startup hiring your first few remote hires or a multinational corporation managing a global workforce, RemotePass can accommodate your requirements.

RemotePass' scalability has empowered businesses like Podeo and Pemo to streamline their global payroll operations as they've grown.

Real-Time Processing for Timely Payments

Eradicating late payments requires a global payroll solution designed for efficiency and accuracy across time zones and currencies. RemotePass tackles this challenge head-on with features like automated international payments and real-time processing. This eliminates the delays associated with manual processing and navigating complex tax regulations.

Additionally, we offer tools for streamlined communication with your global team, ensuring they're aware of their payment schedules and have easy access to paystubs and other critical information.

Multi-Currency Support for Seamless Payments

Fluctuating exchange rates and hidden conversion fees can erode employee earnings and create frustration. A global payroll solution tackles this by offering features like multi-currency support and transparent fee structures. RemotePass excels in this area.

Our platform allows you to pay your team in 90+ currencies, eliminating conversion headaches and ensuring they receive the full value of their salary.

Robust Security

Safeguarding sensitive employee data, like Social Security numbers and bank details, is paramount in global payroll. That's why choosing a provider with robust security features is crucial. Look for a provider like RemotePass that prioritizes data security.

RemotePass takes data security seriously, adhering to rigorous industry standards. Our platform is GDPR and SOC 2 Type II compliant and certified, demonstrating our commitment to protecting your employee information.

Empowering Employees with Financial Flexibility

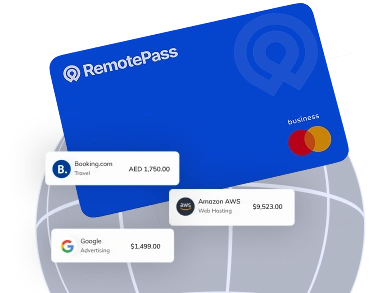

A global payroll solution can be a key driver of financial inclusion for your employees, especially those in regions with limited access to traditional banking systems. RemotePass champions financial inclusion with innovative features.

To start with, our USD Payroll Card provides instant access to earned wages, allowing employees to manage day-to-day expenses without delay.

Further, RemotePass offers 7 payout methods beyond traditional bank transfers, catering to individual preferences and ensuring everyone has convenient access to their salaries. This level of flexibility and control empowers your employees to manage their finances effectively.

Choosing the Right Global Payroll Solution: A Checklist

With a multitude of options vying for your attention, selecting the perfect fit for your business can be a challenge.

To simplify this process, here's a handy checklist to guide you towards the ideal global payroll software.

- Compliance Expertise: Does the provider offer automated regulatory updates and possess a deep understanding of international tax laws and labor standards?

- Scalability: Can the solution adapt to your growing business, accommodating an increasing number of employees, locations, and currencies?

- Data Security: Does the provider prioritize data security with robust encryption, access controls, and adherence to data privacy regulations?

- Transparency: Are their pricing structures clear and free of hidden fees?

- Features and Functionality: Does the platform offer all the features you need, such as multi-currency support, expense management, and time-off tracking?

- Ease of Use: Is the platform user-friendly and accessible for both your HR team and remote teams (contractors and employees)?

- Employee Benefits: Does the solution offer features that benefit your remote workforce, such as instant payments and health insurance options?

RemotePass proudly checks all the boxes on this list, offering a comprehensive suite of features for simplifying global payroll and streamlining your HR operations.

Why Choose RemotePass for Your Global Payroll Needs?

Building a thriving payroll management hinges on efficiency, compliance, and a commitment to your employees' well-being. RemotePass is your dedicated partner in achieving all three.

Here’s why we should be your top pick:

- Effortless Compliance & Peace of Mind: Automated regulatory updates and a team of experts ensure you stay compliant with international tax laws and labor standards. Focus on your core business activities, not paperwork.

- Transparent Costs & Predictable Budgeting: No hidden fees, just clear and concise pricing structures. Make informed decisions and avoid unpleasant surprises.

- Happy & Productive Employees: Attract and retain top talent with features like instant wage access, flexible payouts in their preferred currency, and even health insurance options. Foster financial security and satisfaction within your team.

- Seamless Scalability for Growth: Don't let your payroll solution limit your ambition. RemotePass scales seamlessly as your business expands, accommodating a growing number of employees, locations, and currencies.

Ready to simplify global payroll, empower your team, and propel your business forward?

Get started with RemotePass today!

FAQs About Choosing a Global Payroll Solution

What is global payroll?

Global payroll is the process of paying employees and contractors across multiple countries while managing local tax laws, currency conversions, social security contributions, and labor regulations specific to each jurisdiction.

How does an Employer of Record (EOR) differ from in-house payroll?

An EOR provider becomes the legal employer and handles payroll, taxes, benefits, and compliance on your behalf, while in-house payroll means your company manages all these responsibilities internally with dedicated HR staff and software.

What is permanent establishment (PE) risk in global payroll?

PE risk occurs when a company's activities in a foreign country, such as maintaining a physical office or having employees perform certain functions, create tax residency, subjecting the company to corporate income tax in that country even without a legal entity there.

What currencies does RemotePass support for payroll?

RemotePass supports payments in 90+ currencies, eliminating conversion fees and ensuring employees receive the full value of their salary in their preferred local currency.

What compliance certifications does RemotePass hold?

RemotePass is GDPR compliant and SOC 2 Type II certified, demonstrating adherence to rigorous industry standards for protecting sensitive employee data across global payroll operations.

.svg)

.svg)

_EasiestToDoBusinessWith_EaseOfDoingBusinessWith%20(1).svg)

.svg)